Current Context of Mining Exploration

Do you know which countries have invested the most in exploration in the last 5 years?

Date: 03/10/2023

Authors: Ariana Carrazana Di Lucia y Herman Aguirre-Jofré

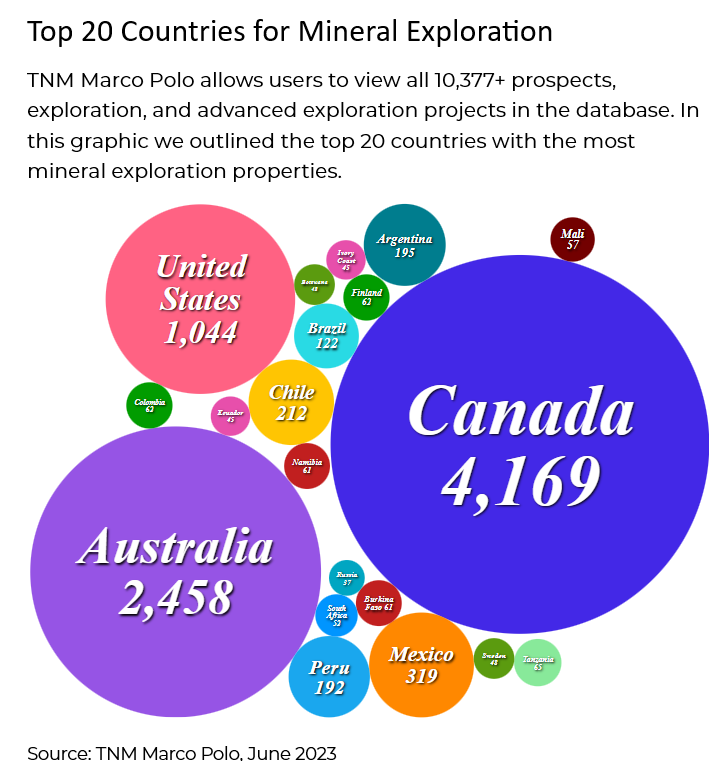

In America, Canada (>4,100 projects), Australia (>2,400 projects), and the United States (>1,000 projects) lead exploration investments and are also the world's main explorers.

In Europe, Sweden, Poland, Finland, Germany, and Spain are among the countries with the highest number of ongoing mining exploration projects.

When comparing Latin America's scenario with the rest of the world in terms of financial resources allocated to mineral exploration, it is evident that Latin America attracts a significant portion of investment and exploitation, especially in countries such as Mexico (>300 projects), Chile (>200 projects), Peru (almost 200 projects), and Brazil (>100 projects), which account for 85% of the region's mineral and metal exports.

Argentina ranked third in the region in mining exploration investment in 2022, with nearly 200 projects. Additionally, Argentina's mining exploration investments exceeded USD 370 million in the same year, reaching the highest level in 10 years.

Regarding the most attractive regions for exploration and investment, the Fraser Institute ranks Chile in sixth place, considering its geological characteristics and government policies.

Other Latin American countries have also experienced an increase in mining investment, such as Ecuador, which had the highest investment attraction index in the mining sector in the region in 2021.

On the other hand, global demand for minerals such as cobalt and lithium has driven exploration investment in countries like Colombia, which currently ranks seventh as an investment destination in Latin America.

China has been investing in mineral exploration and production abroad, especially in Africa and Latin America. The world has raised concerns about dependence on China for critical minerals and the need to diversify supply sources. China has been strengthening its domestic exploration and production of minerals to increase reserves and reduce import dependency.

In Africa, the region has underperformed compared to the global average. Mali became the leading exploration destination in Africa for the first time, recording a 19.1% increase in 2022. However, little data is available for South Africa, which holds nearly 70% of the world's platinum reserves and 80% of manganese reserves, though transparency and clarity issues exist regarding mining and prospecting rights for the country's geological resources.

Source: World leading countries in mineral exploration.

Now that we understand the global context of recent years and the exploration priorities of different regions, let's review the main explorers who have invested the most in recent times.

The world's top 40 miners recorded higher exploration spending than at any time since 2013, focusing on critical minerals such as copper, lithium, and cobalt.

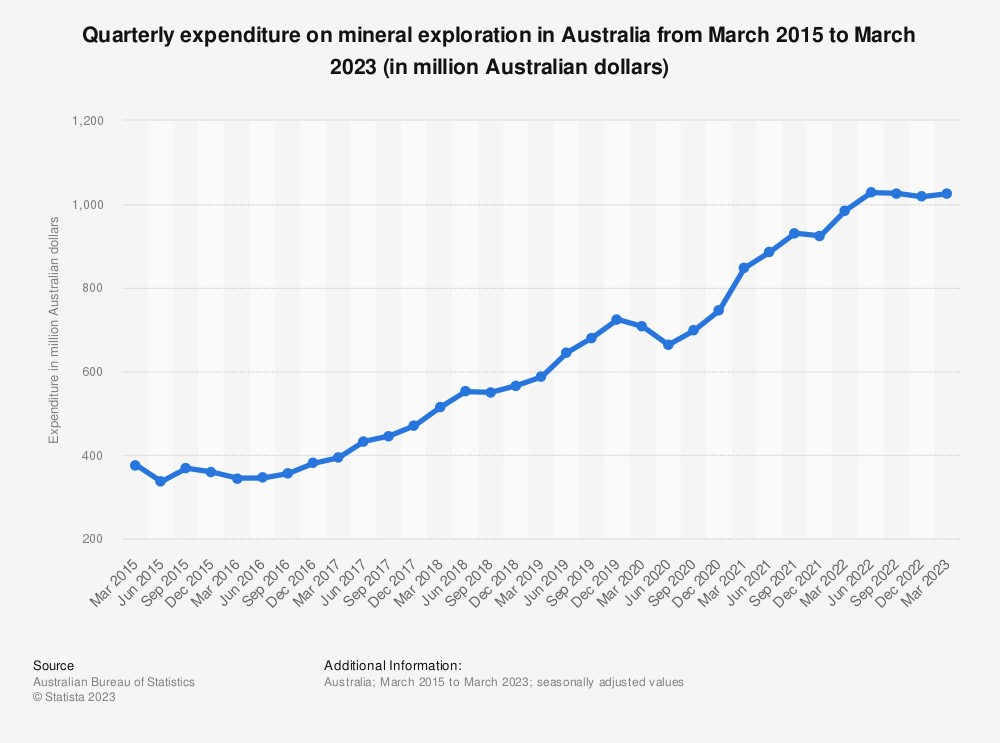

For example, Australia reported quarterly mining exploration expenditure of approximately AUD 1.03 billion as of March 2023. It is important to note that spending on new deposit exploration decreased by 22.2%, and spending on existing deposits declined by 11.2% compared to 2022. However, from March 2015 to March 2023, the country has shown a sustained increase in exploration spending, marking June 2022 as the quarter with the highest exploration expenditure.

Source: Statista.com

In the case of the United States, gold remained the preferred exploration target, accounting for more than half of the region's budget, with USD 881.6 million, according to S&P Global's World Exploration Trends 2023 report.

Companies specializing in lithium development recorded a 50% increase in exploration spending, followed by companies focused on copper and nickel.

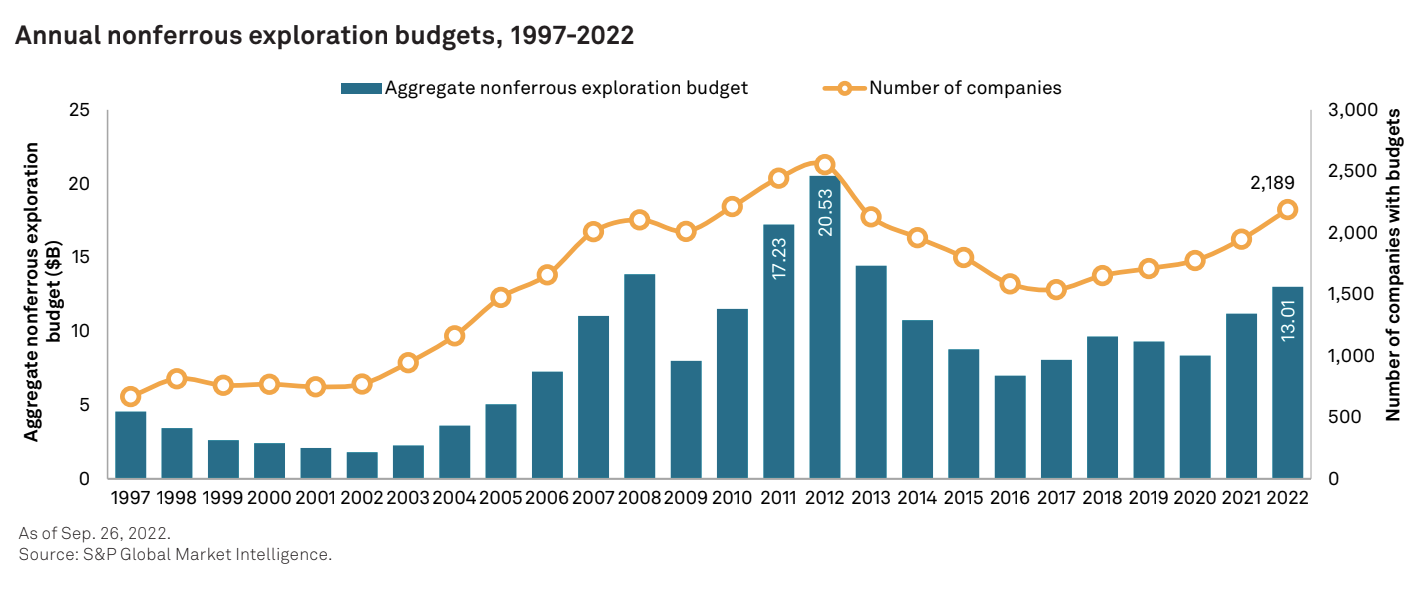

Global non-ferrous exploration budgets reached a nine-year high of USD 13.01 billion in 2022. The increase was driven by growing interest in the global energy transition as part of decarbonization efforts, ongoing post-pandemic recovery, and favorable financing conditions. The backdrop for the metals market is strong prices due to complex geopolitical conditions.

Allocations for most commodities increased in 2022, with budgets for gold and copper being the highest. Energy transition efforts pushed lithium to its highest total to date.

Let's review the historical context with at least a 10-year perspective and explore future projections.

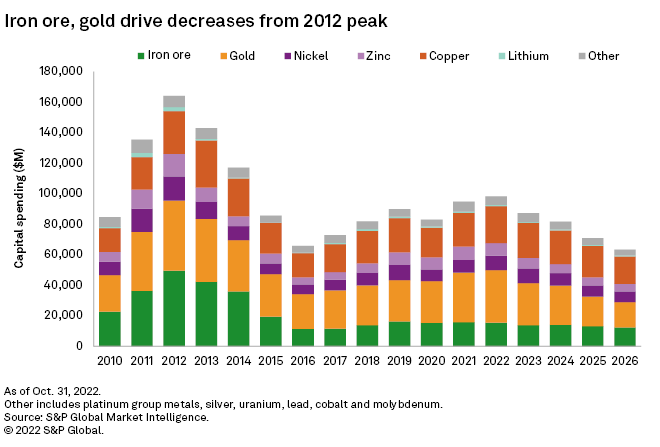

Numerous reports illustrate that capital expenditure peaked in 2012 at USD 164.1 billion due to extremely high spending on iron and gold assets, which together accounted for 58% of total spending that year. Spending fell to a low of USD 65.8 billion in 2016. It gradually recovered to USD 98.3 billion projected for 2022, still 40% below the 2012 peak.

According to Corporate Exploration Strategies 2022, investment in exploration by more established junior companies was weak in 2022, and major mining companies preferred expanding their own projects rather than focusing on new discoveries.

Source: Global Mining Budgets.

Exploration investment was expected to decline in 2023 due to reduced profits, something that can be better assessed in the early months of next year. Nevertheless, we have seen some CEOs of major mining companies, such as Barrick Gold, publicly urging companies to invest more in exploration to ensure a strong portfolio of mining projects.

Source: Planned Mining Capital.

From a business perspective, exploration juniors have regained importance in the mining industry in recent years, something not seen since the 1990s. Additionally, major mining companies have invested in joint ventures and transformative financial operations (e.g., the BHP Xplor program), while some smaller companies have also carried out multi-billion-dollar transactions.

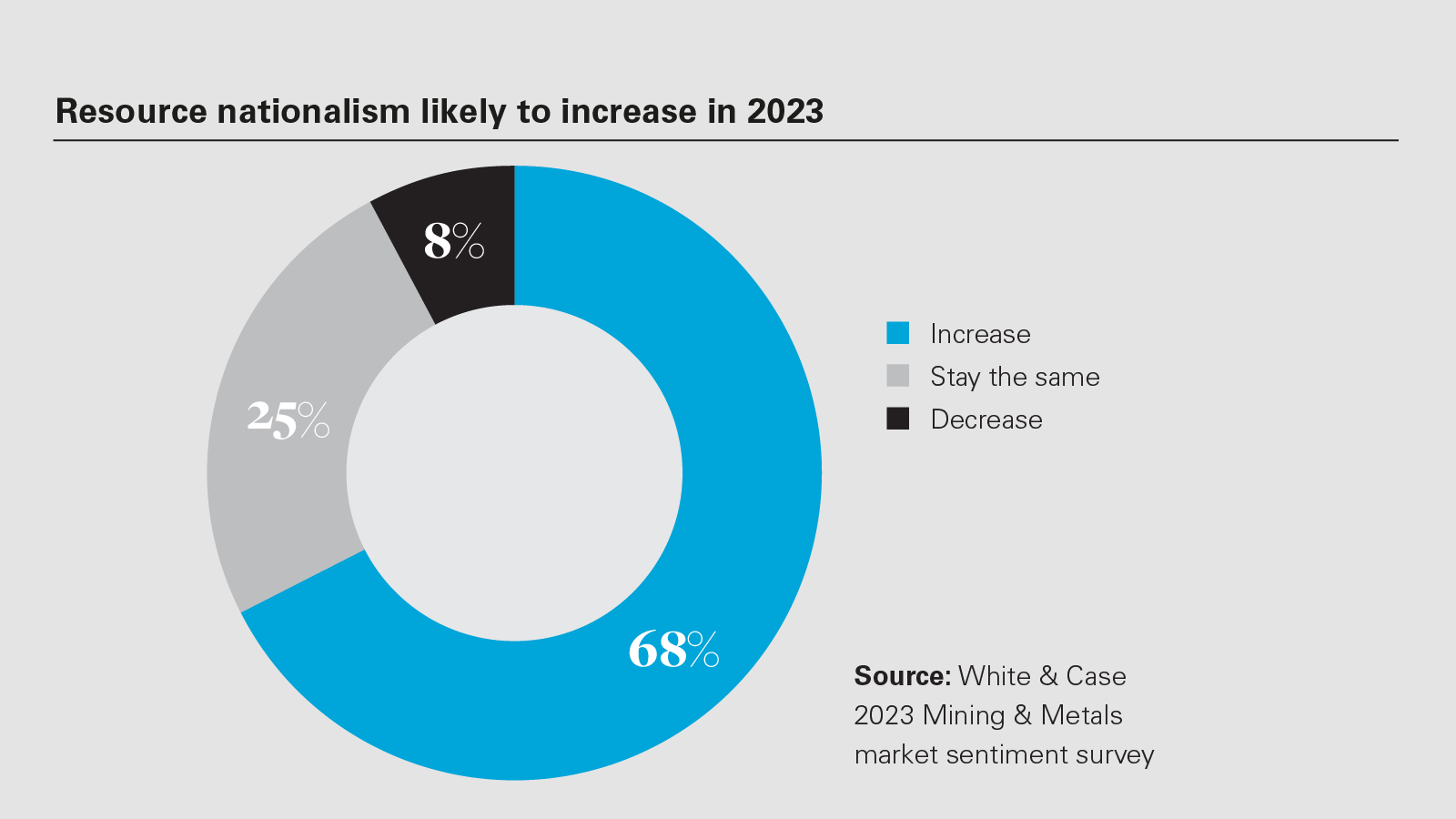

Recently, we have seen that mineral exploration investment has been led by both major and junior companies, some mid-sized, with a strong trend toward state-owned enterprises.

Source: Mining Metlas 2023.

The PDAC (Prospectors & Developers Association of Canada) is an excellent barometer for the world of prospectors and mining explorers. Among the main conclusions from the 2023 edition, we highlight the following:

- Regarding financing, investors are demanding greater transparency in information and ESG (Environmental, Social, and Governance) risk management, which translates into pressure on companies to meet sustainability and decarbonization commitments.

- Investment is concentrating on projects with shorter production horizons, posing a challenge for junior companies that rely on long-term financing for their exploration plans.

- Exploration remains a challenge, as the number of new discoveries continues to decline. The adoption of advanced exploration technologies, such as artificial intelligence and precision geochemistry, is expected to contribute to greater efficiency and success in discovering new deposits.

Achieving net-zero climate goals requires USD 10 trillion worth of metals by 2050. The demand for these materials is immense. Society must understand that it takes an average of 10 to 15 years to transition from a discovery project to a producing mine. Therefore, it is essential to begin explorations in potential areas as soon as possible.

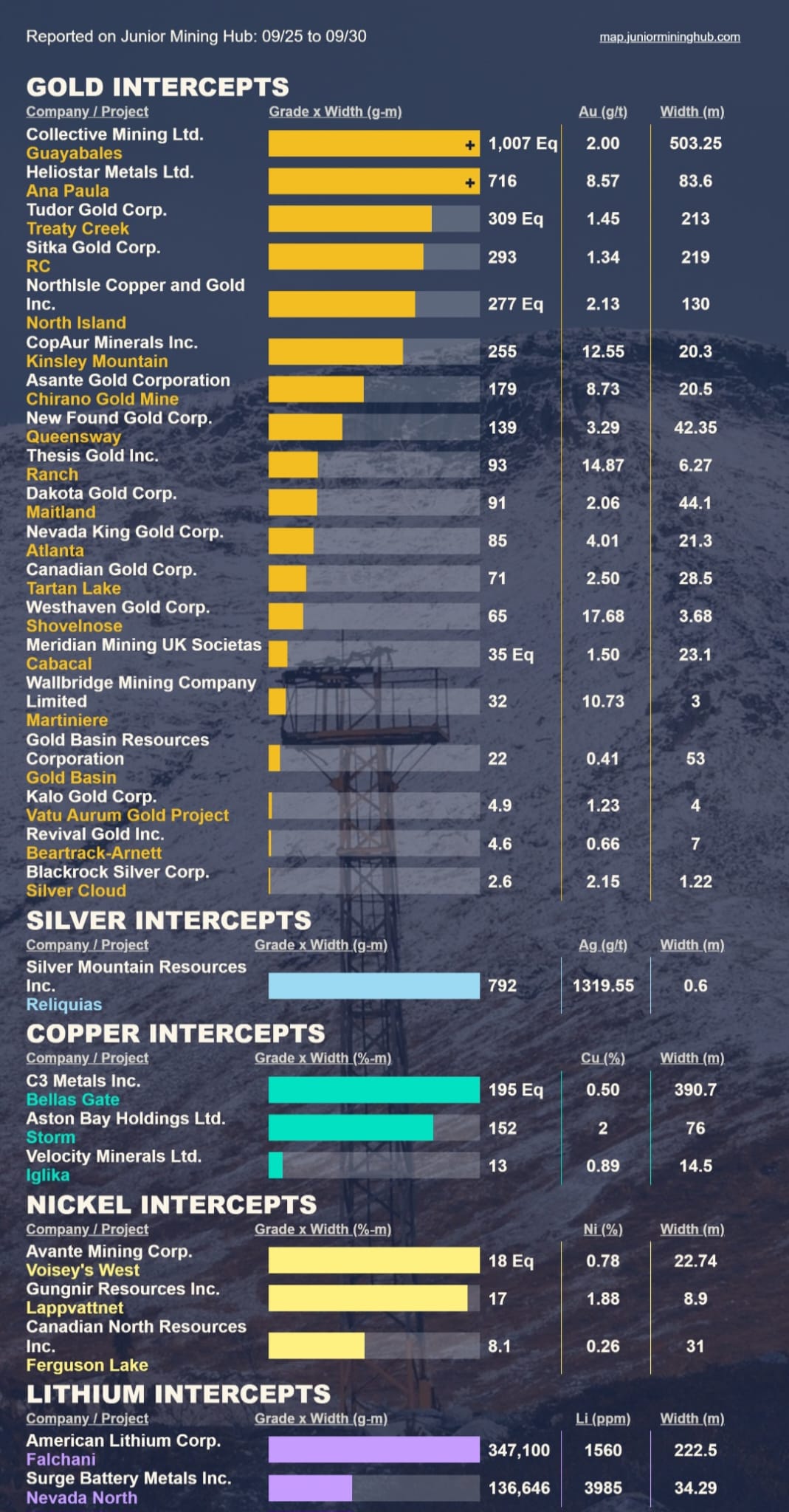

To conclude this summary, in which we have attempted to provide a general overview of some trends, we are pleased to present the most recent and relevant discoveries from the last week of September. This way, you can get a clear idea of what has been researched over the past month and in which areas. We are especially pleased to highlight that some of our esteemed clients are among the top ten on this list. We extend our best wishes for success in achieving their 2023 exploration project goals. Our commitment remains steadfast in maximizing results in their exploratory activities.

Source: Junior Mining Hub.

We hope you enjoy the reading. For inquiries, you can write to us at contacto@miningideas.com

We share with you other documents that might be of interest to you, check the references. You can also visit our blog at www.miningideas.com

References:

- Global Mining Ranking: How Did Latin America Perform? - BNamericas

- Global Mining Investment Ranking: Where Are We Now?

- Copper: Top Producing Countries 2022 - Statista

- Status of Mining in Latin America and the Caribbean: Challenges and Opportunities for More Sustainable Development - Cepal

- Exploration Report in Argentina 2023

- Mining: Sector Results - World Bank

- The Mining Sector in Chile: A Comparative Analysis with Latin American Mining Countries

- Current Overview of Exploration and Its Financing

- Top 5 Junior Mining Companies That Invested the Most in Latin America in 2021

- Junior Miners Raise Over US$180 Million for Latin American Assets

- Junior Mining Companies in Peru

- The Contribution of Junior Companies to Mining Exploration in Chile

You can also visit: